The Following Table Shows the Assets and Liabilities of the Smith Family in 2005 and 2009.

Vacant and Abased Properties: Turning Liabilities Into Assets

Highlights

- The absenteeism of universal definitions of vacancy and abandonment complicates efforts to assess the number of vacant and abandoned backdrop nationally.

- Vacant and abased properties are linked to increased rates of crime (peculiarly arson) and declining property values. The maintenance or demolition of vacant properties is a huge expense for many cities.

- It is critical to match strategies for combating vacancy to neighborhood market conditions.

Vacant lots tin be greened and repurposed for new uses, such every bit this play area in Pittsburgh's Eastward Liberty neighborhood.

Photo courtesy: Sara Innamorato Derelict houses, dormant factories, moribund strip malls, and other types of vacant and abandoned properties are among the well-nigh visible outward signs of a community's reversing fortunes. Properties that take turned from productive utilise to decay are found in cities, suburbs, and rural areas throughout the country, and they vary widely in size, shape, and former use. But these vacant and abandoned properties are more than only a symptom of larger economic forces at work in the community; their association with crime, increased risk to health and welfare, plunging belongings values, and escalating municipal costs make them problems in and of themselves, contributing to overall community decline and disinvestment.ane Local government officials, community organizations, and residents, nonetheless, increasingly view vacant backdrop as opportunities for productive reuse, reimagining blight and dilapidation as urban farms, community gardens, and health facilities. To them, empty homes can go assets in neighborhood stabilization and revitalization that can be renovated and reoccupied.

Vacant and abandoned backdrop have long plagued the industrial cities of America'due south Rust Belt, simply the spike in foreclosures following the recent recession has compounded problems for these areas and has caused vacancy rates to surge nationwide, especially in recently booming Dominicus Belt states such as Florida, Arizona, and Nevada. These communities face up mounting blight and physical deterioration of properties, failing taxation revenues, and ascent public costs. Although nationwide factors (in particular, the foreclosure crisis) helped create these vacancies, local factors — the condition of the properties, the health of the local housing market, and the strength of the regional economy — are what shape the range of options available for returning these backdrop to productive use. The arroyo taken to reclaim one vacant holding among many in a distressed Detroit neighborhood, for case, volition exist different from that taken to reclaim a property in a rebounding Phoenix suburb — or, for that matter, in some other Detroit neighborhood with a healthy housing market.

Local political and economical contexts, as well every bit limitations of chapters and resources, shape the tools that local governments, nonprofits, and neighbors apply to address and reuse vacant and abandoned properties. The about desired outcome is to quickly render a property to its previous apply — an possessor-occupied residence or a thriving business. Yet, tight credit, weak markets, population loss, or other factors may crave other solutions such as demolition, conversion of possessor- occupied housing to rental housing, or replacement (such as constructing a solar subcontract on a one-time industrial site). Strategies for reuse aim to stabilize and revitalize neighborhoods and may stimulate economic recovery and growth or, in the case of shrinking cities, manage decline in ways that improve quality of life for the remaining residents.

Source: The states Census Bureau. 2012. American Community Survey 1-Year Estimates. Notation: Vacant units do not include seasonal, recreational, or occasional uses. Backdrop may become vacant for a diverseness of reasons, some of which are relatively benign. A belongings that is for rent or sale can exist vacant for a short fourth dimension, and a vacation home might be vacant for most of the twelvemonth. If these properties are well maintained past responsible owners, they volition not become eyesores or depress neighboring property values. In general, a vacant belongings becomes a problem when the holding possessor abandons the basic responsibilities of buying, such as routine maintenance or mortgage and property tax payments.2 Multiple variables can lead authorities to designate a property as either vacant or abandoned, including the physical condition of a structure, the amount of time that a property has been in that particular condition, and the human relationship of the owner to the property. For example, in Baltimore, the metropolis building lawmaking defines residences as vacant only if they are uninhabitable, not if they are merely unoccupied.3

The absence of universal definitions of vacancy and abandonment complicates efforts to appraise the number of vacant and abandoned properties nationally. The all-time aggregate sources include the U.S. Census Agency and the U.S. Post, although these are not without limitations. Using these sources, the U.South. Government Accountability Office (GAO) reported in 2011 that vacant residential units, not including those used seasonally or by migrant workers, increased from 7 1000000 in 2000 to ten million in 2010.4 The Joint Center for Housing Studies of Harvard Academy reported that a subset of this category, homes vacant and not being marketed for sale or hire, reached a record high of vii.4 1000000 in 2012, with increases full-bodied in the high-foreclosure areas of the South and West.v Although vacant homes tin can be found throughout the country, they tend to be concentrated; nearly xl pct of the nation's vacant homes are located in just 10 percent of all census tracts.6 More than one-half of the census tracts with vacancy rates of 20 pct or college were in just 50 counties, well-nigh of them in metropolitan areas. Wayne County in Michigan and Cook County in Illinois, for example, each have more than than 200 high-vacancy neighborhoods.7 In addition to the many vacant and abandoned residential properties across the nation, estimates place the number of brownfields — idle former industrial properties with real or perceived environmental contagion — at approximately a half-million.viii

The electric current inventory of vacant backdrop results from two primary causes: the foreclosure crisis as well as long-term urban refuse, depopulation, and disinvestment. Many Rust Belt cities take seen substantial population loss since their twentieth-century peaks as residents left for suburbs or other regions. This reject in the number of households has created a tremendous gap between housing supply and demand. Not only does this mismatch get out many structures vacant, but information technology severely weakens local housing markets, limiting the potential of market-based solutions to vacancy.9 Jobs and retail likewise suburbanized in the latter one-half of the twentieth century, leaving behind former sites of industrial product and commercial activeness. The shrinking population — and the typically lower incomes of those who remain — are often insufficient to back up commercial revitalization.10 Former industrial centers such as Baltimore, Cleveland, Detroit, and Gary, Indiana are dotted with empty factories and accept thousands of foreclosures and vacant residential properties. Sun Chugalug metropolitan areas that were booming just a decade ago at present endure from widespread foreclosures.xi Both residential and commercial foreclosures are at high risk of becoming vacant or abandoned.12 Erstwhile occupants are likely to vacate the property, and considering the costs associated with the foreclosure process are high and the value of a given belongings is often very low, lenders or servicers may walk away.13 In Nevada, Arizona, Florida, and Georgia, all states with high foreclosure rates, nonseasonal vacancies increased by more than 85 percent between 2000 and 2010.fourteen

Vacant and abandoned properties have negative spillover effects that affect neighboring properties and, when concentrated, entire communities and even cities. Research links foreclosed, vacant, and abased backdrop with reduced holding values, increased crime, increased risk to public wellness and welfare, and increased costs for municipal governments.

Studies attempting to quantify the effect of foreclosures on surrounding property values notice that foreclosures depressed the sales prices of nearby homes by every bit little as 0.nine percent to as much equally eight.7 pct.xv Foreclosed homes may or may not become vacant or abandoned, at which betoken a distressed belongings may have a more than pronounced upshot on surrounding properties. In a study of Columbus, Ohio, Mikelbank finds that vacant properties accept a more astringent impact on their firsthand surroundings than do foreclosures, which have a relatively modest impact only over a larger area.sixteen Whitaker and Fitzpatrick too split vacant properties from foreclosures in assessing spillover furnishings, finding that in the Cleveland expanse, being within 500 feet of a vacant holding depresses the auction price of a nondistressed home past i.vii percent in low-poverty areas and 2.i percentage in medium-poverty areas.17 Research also suggests that the longer a property remains vacant, the greater its bear upon on surrounding property values and the larger the radius of this effect.eighteen A study of Baltimore finds that this impact is confined to within 250 feet of properties that have been abandoned for less than 3 years; after iii years, withal, the impact tin extend as far equally 1,500 feet (although at a smaller magnitude).xix

The "I Wish This Were A…" projection in Lansing, Michigan invites community members such equally the adult female pictured to a higher place to reimagine employ of this abandoned store.

Photo courtesy: City of Lansing Development Office Vacant and abandoned properties are widely considered to attract crime because of the "cleaved windows theory" — that i sign of abandonment or disorder (a broken window) will encourage farther disorder.20 Increased vacancies leave fewer neighbors to monitor and combat criminal activity. Boarded doors, unkempt lawns, and broken windows tin signal an unsupervised safe haven for criminal activity or a target for theft of, for example, copper and appliances.21 Cui'southward study of Pittsburgh shows that foreclosure has no result on crime; however, later on a property becomes vacant, the rate of violent crime within 250 feet of the property is 15 percent higher than the rate in the surface area between 250 and 353 feet from the belongings. In add-on, longer periods of vacancy have a greater outcome on criminal offence rates.22 In a study of Philadelphia, Branas, Rubin, and Guo report an clan betwixt vacant backdrop and hazard of assail, finding vacancy to be the strongest predictor amongst almost a dozen indicators after controlling for other demographic and socioeconomic variables.23

Arson is a item problem for vacant and abandoned backdrop. The U.S. Fire Administration estimates that there were 28,000 fires annually in vacant residences between 2006 and 2008, with half of these spreading to the rest of the building and eleven percent spreading to a nearby building. The system also estimates that 37 per centum of these fires were intentionally set and that 45 deaths, 225 injuries, and $900 million in property harm result from these fires each year.24 Considering vacancies are then closely associated with arson, vandalism, and other crimes, local ordinances routinely characterization vacant or abandoned backdrop as a threat to the health and welfare of the community.25

Local governments bear the toll of maintaining, administering, and demolishing vacant and abandoned properties also as servicing them with police and fire protection and public infrastructure. One study calculated that the metropolis of Philadelphia spends more than than $xx 1000000 annually to maintain some 40,000 vacant backdrop, which price a conservatively estimated $five million per year in lost taxation revenue to the city and school district.26 In their 2005 Chicago study, Apgar, Duda, and Nawrocki approximate direct municipal costs ranging from $430 for a foreclosed and vacated property sold at auction to $34,199 for a vacant property destroyed by fire, based on varying durations of vacancy, remediation efforts, and other circumstances such every bit crime.27 Doors and windows must be secured and ofttimes covered with plywood, lawns cutting, and trash removed. Maintenance costs vary co-ordinate to the holding's location and condition. For case, Chicago officials estimated costs of $875,000 to board upward or secure 627 properties in 2010, whereas Detroit officials estimated costs of $i.four million to do the same for vi,000 properties over a period of nearly a year and a half. Backyard mowing costs tin can add up rapidly, as in the case of the $25 spent on each of Detroit's 45,000 city-owned lots and properties.28 A 2009 written report from Baltimore concluded that each vacant property on a block increased annual police and fire expenditures by $1,472.29. According to a study of vacant and abandoned backdrop in Oklahoma Metropolis, commercial properties disproportionately touch on these public safety costs. Although commercial backdrop make upward simply 3 percent of Oklahoma City'southward vacancies, they account for approximately 40 pct of all police and burn down calls.30

Sabotage costs can vary widely based on several factors, including whether the home is attached to occupied residences, such as a Baltimore row firm that can cost $40,000 to annihilate, or whether it contains asbestos or pb-based pigment. GAO states that sabotage typically costs between $4,800 and $7,000 per property.31 Municipalities also incur administrative costs as they search for owners, enforce codes, and oversee foreclosures, although they may recover some of these costs through fines or fees if an owner tin can be identified and compelled to pay. Vacancies also reduce local government revenues directly, because owners may walk away from their revenue enhancement obligations, and indirectly, because of their impact on nearby holding values and taxation assessments. Although in some instances cities can recover this lost revenue through tax lien sales, in others belongings ownership reverts to the urban center, which has no viable choice other than demolition.32

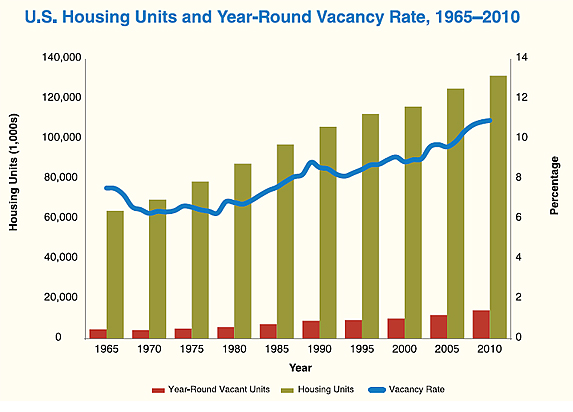

Sources: 1965 to 1999 information from "Table 7. Annual Estimates of the Housing Inventory: 1965 to Nowadays," and 2000 to 2010 information from "Tabular array 7a. Almanac Estimates of the Housing Inventory." U.S. Census Bureau. 2012. "Housing Vacancies and Homeownership: Historical Tables," Current Population Survey/Housing Vacancy Survey. Run into sources for boosted explanatory notes. www.census.gov/housing/hvs/data/histtabs.html. Accessed half-dozen February 2014. Because of the mounting costs and difficulties that vacant and abandoned properties place on communities, government, nonprofit, and community stakeholders are taking measures to stem and even contrary the tide of foreclosure, vacancy, and abandonment. In some cases, the calibration of the problem — and the data infrastructure, code enforcement staff, expertise, and funding required to tackle information technology — overwhelms the chapters of local governments to manage it.33 A significant challenge for most jurisdictions is to identify the number, location, and ownership of vacant backdrop.34 Information regarding possible vacancies is often spread among several agencies, and records of ownership or responsibleness for a property can exist murky, dispersed among occupants, investors, servicers, and lenders. Despite these difficulties, communities need recent and reliable data to understand the problems they face, inform decisionmaking and policy, and tailor responses to the varying weather and characteristics of the cities, neighborhoods, and properties in question.35 To help local officials track trouble properties, many jurisdictions have enacted vacant holding registration ordinances that crave owners to register their belongings and, typically, pay a fee.36 Fees that escalate the longer a property remains vacant can create a disincentive for owners to mothball properties, encouraging them to return these properties to productive use; in addition, acquirement from these fees offsets the costs associated with vacant properties.37

The Reinvestment Fund and the National Neighborhood Indicators Partnership have been disquisitional resources for localities developing information tools and systems to runway and accost their vacant properties. In the metropolis of Syracuse, New York, an IBM Smarter Cities team developed a forecasting model to help place neighborhoods and properties at risk of vacancy-related problems and those in which an intervention would have the greatest bear upon. As the researchers put it, "The city's goal is to move from decision-making based on 'educated anecdotes' and reactive strategies aimed at the most urgent demand, to policy development based on informed, holistic insight, and proactive interventions that prevent and reverse pass up,"38 (encounter "Targeting Strategies for Neighborhood Development").

As local officials learn of potential vacant and abased properties through registration, neighbor complaints, visual surveys, property tax delinquency, or other means, they typically plough get-go to code enforcement and tax liens to make owners take responsibleness for the holding and return it to productive utilise. Vacant and abandoned properties tin quickly fall into enough disrepair that they no longer comply with local building codes. Lawmaking enforcement officials, who are empowered to secure properties that pose a threat to public health, safety, and welfare, can so outcome citations and levy fines on problem properties.39 Successful early intervention is the best course of activity because deterioration compounds apace over time. One of the greatest obstacles to timely and effective code enforcement, co-ordinate to Joseph Schilling, director of the Metropolitan Institute at Virginia Tech, is tracking down and property responsible the owners and servicers of loans in default.40 Real manor owned (REO) properties pose special challenges. Mortgage servicers, which are usually national or international companies, must fence with the local laws and codes that employ to a given belongings. When officials can place the property owners and concur them responsible, they tin ensure that code violations are rectified and mitigate the negative bear on of the property. If the owners are not responsive, local governments tin can take command of the property and pursue the appropriate grade: either rehabilitation or demolition and reuse.

Although neglected budget may exist the almost visible sign of vacancy (and i that is likely to result in a lawmaking violation), "property tax delinquency," Alexander and Powell find, "is the nearly significant mutual denominator amongst vacant and abandoned properties."41 When an possessor stops paying property taxes, local governments initiate a tax-foreclosure process by placing a tax lien on the property. The lien is intended both to recover taxes owed and to prompt the owner to have responsibility for the property. Owners typically have the opportunity to pay off the lien, merely the property reverts to the municipality if the owner has walked away from it. Both lost property tax revenues and reverted properties can pose bug for local governments, although the latter tin can also nowadays an opportunity to exert some control over reuse of the property if the municipality is prepared to do so, such as through a country bank.

When a local government takes ownership of a property, it typically will attempt to transfer responsibility to a new owner equally chop-chop as possible through the sale of either taxation liens or the backdrop themselves. These processes, which tin vary in form, must balance the rights of holding owners with the public'southward interest in promptly moving properties into responsible buying and productive employ. Tax liens and tax-foreclosed backdrop tin be auctioned, sold in majority, or, where legal, transferred to country banks, customs evolution corporations (CDCs), or other nonprofits. In a written report of tax-foreclosure practices in Flint and Detroit, Dewar finds that expedited belongings auctions, which require full payment on the solar day of the auction and do non give bidders an opportunity to assess the quality of the property beforehand, favor investors and speculators. These sales provide municipalities with firsthand acquirement, but they ultimately result in continuing disinvestment and recurring foreclosures.42 Similarly, laws that crave municipalities to sell tax-foreclosed properties to the highest bidder favor speculators over other types of bidders.43 Speculative investment in vacant and abandoned backdrop is not necessarily bad for neighborhood stability; these investors may well be responsible property owners. Dewar argues, still, that more deliberative processes could result in more property being taken over past owner occupants, neighbors, state banks, and nonprofits.44 Amongst the tools bachelor to local governments to discourage irresponsible investors are strict code enforcement; rental registration and licensing; a rental conversion fee imposed when an possessor-occupied belongings becomes a rental; and a requirement that all liens, taxes, and code violations exist resolved before any transfer of property.45

Code enforcement and tax foreclosure tin upshot in owners taking responsibility for or selling properties, public ownership of vacant properties, or public sale of backdrop to new owners. Local marketplace weather condition will govern the possible reuses of these properties. Governments and nonprofits are using data tools to create neighborhood typologies based primarily on market conditions to guide reuse strategies. In stronger markets, policymakers and customs organizations endeavour to prevent vacancies in the start place or keep them from spreading, go responsible owners and occupants into vacant properties as speedily equally possible, and try to stabilize property values and contrary decline. An emerging trend among these stakeholders is to target resources in stronger neighborhoods that are at risk but are not yet distressed.46 In other cases, resources take been concentrated in low-income target areas to accomplish the critical mass needed to sustain private investment.47 In such distressed neighborhoods, markets may be besides weak to facilitate the reoccupancy of vacant properties. In shrinking cities, large-scale demolition and repurposing are needed to reduce the supply of housing to match demand equally well as to bargain with properties that cannot be rehabilitated cost effectively for market sale or rental. (For more particular on the methodologies and applications of such efforts, encounter "Targeting Strategies for Neighborhood Development.")

Strategies for Stronger Markets. Stronger markets offer the possibility of keeping owner occupants in homes at adventure of condign vacant or quickly reoccupying homes that accept already become vacant. Foreclosure prevention programs, rehabilitation for auction, or scattered-site rental housing are among the stronger market strategies that hope to reduce the inventory of vacant homes. Neighborhood marketing and commercial revitalization strategies tin can aid these neighborhoods retain and attract residents by stimulating the demand necessary to reoccupy vacant homes. Some severely dilapidated vacant backdrop in these neighborhoods might still crave demolition, simply these typically would be unmarried lots, which would provide opportunities for minor-scale reuse such equally side-lot adoption or community gardens.

Considering foreclosures are a major cause of vacancy in stronger markets, limiting them could go a long way toward stabilizing these neighborhoods. "Not all distressed borrowers can avoid losing their homes," explains police force professor and fiscal services proficient Patricia A. McCoy, "but in appropriate cases — where modifications can increase investors' return compared to foreclosure and the borrowers can afford the new payments — loan modifications can be a win-win for all."48 Loan modification and refinancing programs, augmented by foreclosure counseling, aim to keep possessor occupants in their homes. Major initiatives in foreclosure prevention include two federal programs: the Home Affordable Modification Program (HAMP) and the National Foreclosure Mitigation Counseling program (NFMC). HAMP has processed more than than one.2 million permanent loan modifications since 2009.49 HAMP participants have high rates of redefault, withal, reaching 46 percent in 2013 for modifications initiated in 2009.fifty A 2012 assessment of HAMP constitute that although the program led to a small reduction in the rate of foreclosures, it reached merely near a third of eligible households and had an adverse effect on loan renegotiations outside of the programme.51 Mayer et al. find better results for NFMC, final that the program improved loan quality for participants, reducing monthly payments past 7.viii percent.52 By keeping possessor-occupants in their homes, foreclosure prevention programs tin can avoid many of the bug such as code violations (the visible signs of neglect) that ascend once a property becomes vacant.

In partnership with community-based Operation Better Block'due south Jr. Dark-green Corps, Pittsburgh nonprofit GTECH Strategies engaged local youth to green this vacant lot in the Homewood neighborhood.

Photo courtesy: GTECH Strategies Vacant properties may require rehabilitation before they can be reoccupied. Healthy markets may offer private investors sufficient economic incentives to purchase, rehabilitate, and resell formerly vacant backdrop. In other cases, public subsidy or a nonprofit's intervention may be able to turn a vacant dwelling into an owner-occupied one. Although owner occupancy might be the most desirable reuse of foreclosed and vacated backdrop, investor activeness, through both market sale and tax-foreclosure auctions, has opened up scattered-site rental of single-family homes as one manner of dealing with still-habitable residences located in neighborhoods with sufficient rental demand. Danilo Pelletiere, former research manager of the National Depression Income Housing Coalition and current HUD economist, suggests that "the new and returning households that are needed to reduce vacancy and stabilize neighborhoods are most likely to be renters, whether by choice or from necessity, a tendency that is already appreciable."53 CDCs would also probable have an interest in acquiring revenue enhancement-foreclosed properties and operating them as rentals, both to increase the stock of affordable housing and to stabilize the neighborhoods in which they have already invested. CDCs are likely to face significant challenges, however, in managing scattered-site rental properties, which by one estimate cost 25 to thirty percent more than to manage compared with multifamily properties.54 "Kickoff wait" programs permit nonprofits or a detail type of buyer, such every bit neighbors, to bid on REO or tax-foreclosed properties earlier other investors practise. The National Commencement Look Program gives Neighborhood Stabilization Programme grantees the opportunity to acquire properties owned by Fannie Mae and Freddie Mac before they are offered to the highest bidder.55 In some instances, lenders or mortgage servicers may agree to hire to the sometime owners of foreclosed homes, offering some of the same benefits to the community equally foreclosure prevention.56

Strategies to reoccupy vacant homes, either past owners or renters, depend on a neighborhood's power to retain and concenter residents. Efforts to marketplace a neighborhood can assist stabilize housing markets and reduce vacancy and abandonment. The Salubrious Neighborhoods Initiative of the Greater Milwaukee Foundation, for case, conducted tours of neighborhoods that it had targeted for epitome promotion, resulting in the sale of 22 vacant homes to first-time homebuyers.57 NeighborWorks America, a national housing and community development nonprofit, has recognized neighborhood marketing and branding as a strategy for strengthening housing demand and alluring private investment. In 2012, the system worked intensively with 16 neighborhood organizations to aggressively market neighborhoods.58

Residential stabilization and revitalization would exist aided and complemented by commercial revitalization in areas with markets strong enough to support it. Vibrant residential neighborhoods tin amend support neighborhood retail, and abundant retail options, in plow, volition help attract and retain residents. "Rebuilding neighborhood retail should be planned comprehensively as an integral piece of the larger customs that surrounds it, and it should exist tailored to the realities of the area," write Beyard, Pawlukiewicz, and Bond.59 They argue that public-private partnerships with a long-term commitment to reinvestment are necessary to rebuild neighborhood retail.60

The community of McAllen, Texas reclaimed this abandoned big box shop equally a new home for its chief public library.

Photograph courtesy: McAllen Public Library Fifty-fifty in neighborhoods with relatively healthy housing markets, nevertheless, selective demolition may be necessary when vacant properties are severely dilapidated. When the cost of rehabilitating a vacant or abandoned property exceeds its expected marketplace value subsequently rehabilitation, market-based solutions would be unlikely to result in remediation. Although a vacant lot typically has less agin touch on surrounding backdrop than a vacant or abased structure, demolition programs could also programme for what to exercise with the vacant lot that remains once the construction is removed, such as turning the lot into a landscaped pedestrian pathway or bicycle trail, a park, a parking lot, or a community garden.61 Research shows that the Pennsylvania Horticultural Order'south Philadelphia LandCare program, which clears and landscapes vacant lots, has improved residents' perception of safety, reduced sure gun crimes, and boosted property values.62 Vacant properties that take been reused as community gardens, according to i written report, have a positive upshot on nearby property values upward to 1,000 feet from the garden. The researchers find that these gardens can have the greatest impact in high-poverty neighborhoods.63

Strategies for Weak Markets and Shrinking Cities. In neighborhoods where housing markets are weak, where supply far exceeds demand, and in cities that are losing population, many of the strategies discussed above are unlikely to consequence in possessor-occupied use of once-vacant properties. As Mallach and Brachman advise, "Cities such as Youngstown or Detroit, where 30 pct of their state areas are vacant — and which continue to lose population — need to think most state reutilization in fundamentally unlike ways than a city in which x percent or less of its state area is vacant, or where the city'due south population appears to be stabilizing, such equally Milwaukee or Newark."64 Even cities with overall population stability or growth may still have neighborhoods or groups of neighborhoods in which markets cannot support revitalization strategies such as scattered-site rental housing or neighborhood marketing.

Cities that have lost one-half or more of their peak populations have a far larger housing supply, transportation and utilities infrastructure, and service area than they have people to utilize and pay for them. For decades, planners and politicians alike have attempted to grow their cities out of such problems. Increasingly, however, they are looking toward "rightsizing" or "smart decline" as a fashion to adjust city services and housing stock to adjust smaller populations. Youngstown, Ohio and Flint, Michigan are ii cities in which planners accept explicitly acknowledged the demand to adjust to declining populations.65 Rightsized cities will more efficiently classify limited resources if, for example, residents are full-bodied in denser areas, allowing the city to shunt infrastructure currently serving few residents. But, says Brent D. Ryan, professor of urban design and public policy at the Massachusetts Constitute of Engineering science, rightsizing is a controversial, "yet-unproved procedure" that raises problems of disinterestedness, among others.66 Metropolis officials cannot forcefulness residents to relocate to denser areas, and creating incentives to encourage residents to leave their homes tin exist hard. Even cities with rampant vacancy have residents scattered amongst otherwise empty blocks.67

The interventions that may be necessary to address vacant and abased properties in neighborhoods with weak markets and in shrinking cities include large-scale demolition and repurposing.68 Cities such as Buffalo, which in the 2000s conducted a "v in 5" entrada to annihilate v,000 properties in 5 years, tin can barely proceed up with the backlog of thousands of vacant properties.69 Equally noted above, demolition can be extremely costly. To aid state and local efforts to fund large-calibration demolition, the U.S. Section of the Treasury has authorized the use of the Hardest Hit Fund (office of the Troubled Asset Relief Programme) for demolition in 18 eligible states and the District of Columbia, although no funds had been expended for that purpose every bit of June 30, 2013.70 In Ohio, the attorney general chose to designate upwards to $75 meg of the state's share of the National Mortgage Settlement to reimburse counties for demolition. As of February 4, 2014, Ohio counties had expended over $65 1000000 to annihilate eight,390 units, with approximately $41 one thousand thousand of that full reimbursed by the chaser full general.71 Although these funding sources are vital for communities struggling to keep up with sabotage demands, they are not ongoing, and then alternatives will exist needed if large numbers of properties continue to be slated for demolition.

Large swaths of vacant country require large-calibration repurposing strategies such as urban agriculture, woodlands, or parks and recreation facilities.72 Such green reuses hope the added benefit of improving stormwater management. Heavy rainstorms frequently overwhelm the combined sewer and stormwater infrastructure of many older cities, forcing them to dump untreated sewage mixed with stormwater into waterways at an estimated rate of 850 billion gallons annually.73 Diverting rainwater to these xiii repurposed properties not only addresses this significant ecology problem but also reduces air pollution and surface area temperatures, lowers municipal stormwater management costs, and enhances neighborhood aesthetics.74 Land banks tin can exist peculiarly effective in cyberbanking contiguous lots for larger repurposing projects (see "Countywide Lank Banks Tackle Vacancy and Blight"). Brownfields, which are mutual in former industrial centers, nowadays opportunities for large-scale repurposing as open dark-green or recreational spaces, customs gardens or farms, or brightfields — sites for generating wind or solar power.75 Would-exist developers of brownfields must consider the costs of site assessment, remediation, and liability against turn a profit expectations, which tin can exist limited by weak markets and other macroeconomic factors.76 Creative, organic, and sometimes temporary uses of vacant country sally when neighbors and other residents act alee of city governments, land banks, or developers (see "Temporary Urbanism: Culling Approaches to Vacant Country"). In Brightmoor, a Detroit neighborhood with a high vacancy rate and a population of roughly ane,700, residents purchased or took responsibility for nearly 100 nearby vacant lots, consolidating them with their own property for their ain employ. Sometimes such organic use is illegal, as in the instance of scavenging or squatting.77

Turning Liabilities Into AssetsVacant and abandoned properties present daunting challenges to communities nationwide. Bear witness shows that vacant and abandoned properties drag downward local economies, impede population growth, depress holding values, increase law-breaking, and impose heavy price burdens on local governments.

An instance of successful brownfield redevelopment, the former Pfister & Vogel leather tannery (left) is now the site of The N Terminate apartments along the Milwaukee River in downtown Milwaukee, Wisconsin (right).

Photo courtesy: Mandel Group Cities and communities are increasingly using data to inform the targeted deployment of limited resources and are addressing trouble properties with a range of strategies that fit local market and demographic atmospheric condition. "What yous accept to be able to do," says Alan Mallach of the Brookings Establishment and the Centre for Community Progress, "is to come up with ways to reuse the lots so that they volition hopefully enhance, and at a minimum not backbite from, the attractiveness of the neighborhood to homebuyers, investors, and rehabbers."78 In some cases, such measures might spur redevelopment and economic revitalization. In other cases, it might be more appropriate to focus on managing decline in ways that improve the quality of life for those who remain. "Instead of cities focusing and then much on growing, they should actually focus on making themselves attractive and having the market respond to that," says Justin Hollander, associate professor of urban and environmental policy and planning at Tufts University. "If a identify becomes more than desirable, information technology likely volition lead to farther growth in the future."79

More than research volition exist needed to empower policymakers, investors, and citizens to make evidence-based decisions on hard choices, such every bit when to rehabilitate and when to demolish, whether to have a judicial or authoritative foreclosure process, whether to convert a brownfield to an affordable housing evolution or a green space, or whether a particular area should pursue smart growth or smart decline. Innovative design techniques promise to expand the range of options for reuse. Equally practitioners experiment with artistic new uses of formerly vacant and abandoned properties, researchers volition need to evaluate strategies and determine which piece of work and which practice not, which are virtually cost effective, and which are nigh sustainable. More research will help decisionmakers go meliorate equipped to turn trouble properties into assets that will stabilize and revitalize neighborhoods and improve residents' quality of life.

:

Federal Resources Aid Local Responses

A Fresh Face for Vacant and Abandoned Buildings

- John Accordino and Gary T. Johnson. 2000. "Addressing the Vacant and Abandoned Property Problem," Journal of Urban Diplomacy 22:iii, 302–iii.

- Margaret Dewar and June Manning Thomas. 2013. "Introduction: The City After Abandonment," in Margaret Dewar and June Manning Thomas, eds., The City After Abandonment, Philadelphia: Academy of Pennsylvania Press, 2.

- U.South. Government Accountability Office. 2011. "Vacant Properties: Growing Number Increases Communities' Costs and Challenges," ix.

- Ibid., 12.

- Articulation Heart for Housing Studies. 2013. The State of the Nation's Housing , 2013, Harvard University, 9.

- Elizabeth A. Duke. 2012. "Addressing Long-Term Vacant Properties to Support Neighborhood Stabilization," voice communication at the Federal Reserve Bank of New York, 3.

- Articulation Centre for Housing Studies, 31–2.

- Justin B. Hollander, Niall Yard. Kirkwood, and Julia L. Aureate. 2010. Principles of Brownfield Regeneration: Cleanup, Design, and Reuse of Derelict Land, Washington, DC: Isle Press, i, iv.

- Alan Mallach and Jennifer S. Vey. 2011. "Recapturing Land for Economic and Financial Growth," Brookings-Rockefeller Projection on State and Metropolitan Innovation, 1.

- Anastasia Loukaitou-Sideris. 1997. "Inner-City Commercial Strips: Evolution, Decay — Retrofit," The Town Planning Review 68:1, iii–4; Daniel Hartley. 2013. "Urban Reject in Rust-Chugalug Cities," Federal Reserve Bank of Cleveland; Michael D. Beyard, Michael Pawlukiewicz, and Alex Bail. 2003. "10 Principles for Rebuilding Neighborhood Retail," Urban State Institute, iv.

- Justin Hollander, Colin Polsky, Dan Zinder, and Dan Runfola. 2011. "A Spatial Analysis of Housing Vacancy in the The states – 2000-2011," Lincoln Institute of Land Policy, 4; Margaret Dewar. 2009. "The Furnishings on Cities of 'Best Practice' in Tax Foreclosure: Evidence from Detroit and Flint," CLOSUP Working Newspaper Serial, No. two, 1; Mallach and Vey, 1.

- Hye-Sung Han. 2013. "The Touch on of Abased Properties on Nearby Property Values," Housing Policy Debate, 4; Beak Barnes, Christina McFarland, and Caitlin Geary. 2011. "The Reign of Hurting: Vacant and Abandoned Properties in Your Downtown," Due south Dakota Municipalities, 24–5.

- Han, four.

- U.S. Government Accountability Office, 14.

- Scott Due west. Frame. 2010. "Estimating the Consequence of Mortgage Foreclosures on Nearby Property Values: A Disquisitional Review of the Literature," Economic Review: Federal Reserve Bank of Atlanta 95:3, 6–7; Dan Immergluck and Geoff Smith. 2006. "The External Costs of Foreclosure: The Impact of Single-Family unit Mortgage Foreclosures on Property Values," Housing Policy Debate 17:one, 57; Zhenguo Lin, Eric Rosenblatt, and Vincent Westward. Yao. 2009. "Spillover Effects of Foreclosures on Neighborhood Property Values," Periodical of Real Estate, Finance, and Economics 38:4, 387. The lower estimate is from Immergluck and Smith and the higher one is from Lin, Rosenblatt, and Yao.

- Brian A. Mikelbank. 2008. "Spatial Analysis of the Impact of Vacant, Abandoned and Foreclosed Backdrop," Federal Reserve Banking company of Cleveland, 2.

- Stephan Whitaker and Thomas J. Fitzpatrick IV. 2012. "Deconstructing Distressed-Holding Spillovers: The Effects of Vacant, Tax-Delinquent, and Foreclosed Properties in Housing Submarkets," Federal Reserve Depository financial institution of Cleveland, 24.

- Han, 21.

- Ibid., 20.

- The broken window theory gained wide audience in George 50. Kelling and James Q. Wilson. 1982. "Broken Windows: The Police and Neighborhood Safe," The Atlantic Monthly 249:three, 29–38.

- Ashley Due north. Arnio, Eric P. Baumer, and Kevin T. Wolff. 2012. "The Gimmicky Foreclosure Crisis and US Crime Rates," Social Science Research 41:6, 1599–1600.

- Lin Cui. 2010. "Foreclosure, Vacancy and Crime," Department of Economics, University of Pittsburgh, 23.

- Charles C. Branas, David Rubin, and Wensheng Guo. 2012. "Vacant Properties and Violence in Neighborhoods, International Scholarly Inquiry Network: Public Health 2012, five.

- U.S. Fire Administration. 2010. "Vacant Residential Building Fires," Topical Fire Study Series 11:three, 1.

- Benton C. Martin. 2010. "Vacant Property Registration Ordinances," Real Estate Law Journal 39:1, 12–3.

- Econsult Corporation, Penn Institute for Urban Enquiry, and May 8 Consulting. 2010. "Vacant State Direction in Philadelphia: The Costs of the Current System and the Benefits of Reform," Redevelopment Authority of the City of Philadelphia, ix, 11.

- William C. Apgar, Mark Duda, and Rochelle Nawrocki Gorey. 2005. "The Municipal Toll of Foreclosures: A Chicago Example Report," Homeownership Preservation Foundation, 23.

- U.Due south. Government Accountability Office, 37–8.

- Bob Winthrop and Rebecca Herr. 2009. "Determining the CO$T of Vacancies in Baltimore," Regime Finance Review 25:3, 39.

- GSBS Richman Consulting. 2013. "Addressing Vacant & Abandoned Buildings in Oklahoma City: Prevalence, Costs + Plan Proposal," 12.

- U.S. Regime Accountability Part, 39–40.

- Ibid., 40–ane.

- Ibid., 69; Carolina K. Reid. 2010. "Shuttered Subdivisions: REOs and the Challenges of Neighborhood Stabilization in Suburban Cities," REO & Vacant Properties: Strategies for Neighborhood Stabilization, eds. Prabal Chakrabarti, Matthew Lambert, and Mary Helen Petrus, Federal Reserve Banks of Boston and Cleveland and the Federal Reserve Board, 23–four.

- Roberta F. Garber, Jung Kim, Kerry Sullivan, and Eben Dowell. 2008. "$lx Million and Counting: The Price of Vacant and Abandoned Properties to 8 Ohio Cities," Community Inquiry Partners, iii-3.

- Kathryn 50.S. Pettit and Chiliad. Thomas Kingsley. 2011. "Framework: The New Potential for Information in Managing Neighborhood Change," in Putting Data to Work: Data-Driven Approaches to Strengthening Neighborhoods, eds. Matt Lambert and Jane Humphreys. Board of Governors of the Federal Reserve System, 27–viii.

- For more on vacant property registration ordinances, run across Yun Sang Lee, Patrick Terranova, and Dan Immergluck. 2013. "New Data on Local Vacant Holding Registration Ordinances," Cityscape: A Journal of Policy Development and Enquiry 15:2, 259–66; Martin, half dozen–43.

- Joseph Schilling. 2009. "Lawmaking Enforcement and Customs Stabilization: The Forgotten Beginning Responders to Vacant and Foreclosed Homes," Albany Government Law Review ii, 127, 131.

- Sheila U. Appel, Derek Botti, James Jamison, Leslie Establish, Jing Y. Shyr, and Lav R. Varshney. Forthcoming. "Predictive Analytics can facilitate proactive property vacancy policies for cities," Technological Forecasting and Social Change, 2. Corrected proof available at www.sciencedirect.com/science/article/pii/S0040162513002138 . Accessed 1 February 2014.

- Keith H. Hirokawa and Ira Gonzalez. 2010. "Regulating Vacant Property," The Urban Lawyer 42:3, 627–37, 629.

- Schilling, 124.

- Frank S. Alexander and Leslie A. Powell. 2011. "Neighborhood Stabilization Strategies for Vacant and Abandoned Backdrop," Zoning and Planning Police Report 34:8, 3.

- Dewar 2009, 1–3, 22–iii.

- William Weber. 2013. "Tax Foreclosure: A Elevate on Community Vitality or a Tool for Economic Growth?," University of Cincinnati Law Review 81:4, 1628–30.

- Dewar 2009, 22–3.

- Sarah Treuhaft, Kalima Rose, and Karen Blackness. 2010. "When Investors Buy Up the Neighborhood: Preventing Investor Buying from Causing Neighborhood Decline," PolicyLink, half-dozen, 24, 28–ix; O. Emre Ergungor and Thomas J. Fitzpatrick 4. 2011. "Slowing Speculation: A Proposal to Lessen Undesirable Housing Transactions," Forefront, Federal Reserve Banking concern of Cleveland.

- Dale E. Thomson. 2013. "Targeting Neighborhoods, Stimulating Markets: The Role of Political, Institutional, and Technical Factors in Three Cities," in The Metropolis Later on Abandonment, 104.

- George Galster, Peter Tatian, and John Accordino. 2006. "Targeting Investments for Neighborhood Revitalization," Journal of the American Planning Association 72:4, 458.

- Patricia A. McCoy. 2013. "Barriers to Foreclosure Prevention During the Fiscal Crisis," Arizona Constabulary Review 55: 3, 725.

- U.S. Department of Housing and Urban Development. 2013. "The Obama Administration's Efforts to Stabilize The Housing Market place and Help American Homeowners: December 2013," i.

- Office of the Special Inspector General for the Troubled Asset Relief Program. 2013. "Quarterly Report to Congress," SIGTARP (July 24, 2013), 161.

- Sumit Agarwal, Gene Amromin, Itzhak Ben-David, Souphala Chomsisengphet, Tomasz Piskorski, and Amit Seru. 2012. "Policy Intervention in Debt Renegotiation: Evidence from the Home Affordable Modification Program," National Agency of Economic Enquiry, ii.

- Neil Mayer, Peter A. Tatian, Kenneth Temkin, and Charles A. Calhoun. 2012. "Has Foreclosure Counseling Helped Troubled Homeowners?: Evidence from the Evaluation of the National Foreclosure Mitigation Counseling Program," Metropolitan Housing and Communities Centre, four.

- Danilo Pelletiere. 2010. "Embracing Renting to Accelerate Neighborhood Recovery," Chakrabarti et al.,137.

- Ivan Levi. 2009. "Stabilizing Neighborhoods Impacted by Concentrated Foreclosures: Scattered-Site Rental Housing Challenges and Opportunities," NeighborWorks America, 13.

- U.S. Department of Housing and Urban Development. 2010. "HUD Secretary Announces National Beginning Await Program to Assistance Communities Stabilize Neighborhoods Hard-Hit by Foreclosure," 1 September press release. The Neighborhood Stabilization Program is a federal program, funded in three phases, designed to assistance local governments in responding to the foreclosure crisis. Activities include buy, rehabilitation, sabotage, and reuse of foreclosed and vacant properties. Come across Paul A. Joice. 2011. "Neighborhood Stabilization Programme," Cityscape: A Journal of Policy Development and Enquiry 13:ane, 136–8.

- Pelletiere, 133.

- Greater Milwaukee Foundation. 2012. "Good for you Neighborhoods Initiative: 2012 Highlights," 3.

- "NeighborWorks America Announces New Neighborhood Marketing and Branding Initiative to Help Communities Hurt past the Housing Crisis Attract New Investment and Residents," 26 July 2012 press release.

- Beyard, et al., 22.

- Ibid., vii–eight.

- Alan Mallach. 2012. "Laying the Groundwork for Modify: Demolition, Urban Strategy, and Policy Reform," Brookings Metropolitan Policy Program, 3–5, 29; Kent State Academy, Cleveland Urban Pattern Collaborative. 2009. "Re-imagining Cleveland: Vacant Land Re-use Pattern Volume," Neighborhood Progress, Inc., 14, 17, 26.

- On law-breaking and health see Eugenia C. Garvin, Carolyn C. Cannuscio, and Charles C. Branas. 2012. "Greening Vacant Lots to Reduce Vehement Criminal offence: A Randomised Controlled Trial," Injury Prevention 2013:19, 198; and on property values see Susan M. Wachter, Kevin C. Gillen, and Carolyn R. Chocolate-brown. 2008. "Greenish Investment Strategies: A Positive Force in Cities," Communities & Banking 19:2, 24–seven.

- Ioan Voicu and Vicki Been. 2008. "The Issue of Community Gardens on Neighboring Holding Values," Real Estate Economics 36:2, 241–83, 243.

- Alan Mallach and Lavea Brachman. 2010. "Shaping Federal Policies Toward Cities in Transition: A Policy Cursory," Greater Ohio Policy Heart, 6.

- Margaret Dewar, Christina Kelly, and Hunter Morrison. 2013. "Planning for Better, Smaller Places After Population Loss: Lessons from Youngstown and Flint," in The City After Abandonment, 291.

- Brent D. Ryan. 2013. "Rightsizing Shrinking Cities: The Urban Pattern Dimension," in The Urban center Afterward Abandonment, 268, 282–3.

- Ibid., 270.

- U.S. Ecology Protection Agency. 2013. "On the Road to Reuse: Residential Demolition Bid Specification Development Tool," 5.

- Ryan, 269.

- Office of the Special Inspector General for the Troubled Asset Relief Programme. 2013. "Quarterly Report to Congress," SIGTARP (October 29, 2013), 99–100.

- Ohio Attorney General. 2013. "Attorney Full general Extends Deadline for Counties to Employ for Demolition Funds," 29 August printing release; Interview with Matt Lampke, Mortgage Foreclosure Counsel, 4 February 2014.

- Detroit Works Project. 2012. Detroit Future Urban center: Detroit Strategic Framework Program, Detroit Works Project,93, 99, 103, 116, 117.

- Nancy Stoner, Christopher Kloss, and Crystal Calarusse. 2006. "Rooftops to Rivers: Light-green Strategies for Controlling Stormwater and Combined Sewer Overflows," Natural Resources Defense Council, 1, iv.

- Ibid., 10–11.

- Hollander, Kirkwood, and Gold, 54–five.

- Ibid., 1–four, xvi.

- Dewar and Thomas 2013, 7–x.

- Interview with Alan Mallach, thirteen November 2013.

- Interview with Justin Hollander, 12 November 2013.

martincrautepred02.blogspot.com

Source: https://www.huduser.gov/portal/periodicals/em/winter14/highlight1.html

Post a Comment for "The Following Table Shows the Assets and Liabilities of the Smith Family in 2005 and 2009."